Student Spotlight

We feature some of our favorite student pieces from recent sessions here! Join our sessions to be published!

Student: Emily Wang

Piece: My Investment Simulation Portfolio

During the Investing 101 session, I created a mock investment portfolio with the goal of learning how to diversify investments and grow wealth over time. I chose to invest in three main sectors: technology, healthcare, and energy.

-

Tech Sector: I allocated 50% of my portfolio to tech stocks, with a focus on companies like Apple and Microsoft. My reasoning was that these companies have strong growth potential and are leaders in innovation. Both companies also pay dividends, which provided me with a steady stream of passive income in the simulation.

-

Healthcare Sector: I invested 30% in Pfizer and Johnson & Johnson due to their strong presence in pharmaceuticals and healthcare. After learning how healthcare tends to perform well even in economic downturns, I wanted to balance my tech-heavy portfolio with these stable stocks.

-

Energy Sector: Lastly, I invested 20% in NextEra Energy, a company focused on renewable energy. After researching the growing importance of sustainability, I wanted to align my portfolio with future trends in clean energy.

Through weekly tracking, I experienced how market news—like product launches from Apple or healthcare innovations from Pfizer—affected stock prices. I was surprised by the volatility in the tech sector, which fluctuated more than the others, but over time, it also offered the highest return in my simulation. This exercise showed me how important diversification is and gave me the confidence to explore real-world investments in the future.

Student: Priya Patel

Piece: My First Real Estate Investment Proposal

In the Real Estate and Long-Term Investing session, I developed a plan for my first real estate investment. My goal was to purchase a duplex in a growing suburban area and rent it out to tenants, creating a source of passive income.

-

Property Location: I chose to invest in the suburbs of Austin, Texas, an area experiencing rapid population growth due to its booming tech industry. After analyzing the market, I found that property values in Austin were appreciating faster than in other regions, making it a prime location for long-term investment.

-

Investment Strategy: I estimated the purchase price of the duplex at around $400,000. By securing a mortgage with a 20% down payment, I would be able to finance the property with minimal upfront capital. I planned to rent out both units for $1,500 per month each, which would cover the mortgage payments, property taxes, and maintenance costs while generating positive cash flow.

-

Long-Term Growth: Over time, as the property value increases and the mortgage gets paid down, I would build equity in the duplex. My goal was to hold the property for 10 years, after which I could sell it for an estimated $600,000, profiting from both rental income and property appreciation.

This exercise taught me the importance of location and financial planning in real estate. By carefully choosing an area with growth potential and calculating the cash flow, I saw how real estate could be a key component of a long-term wealth-building strategy.

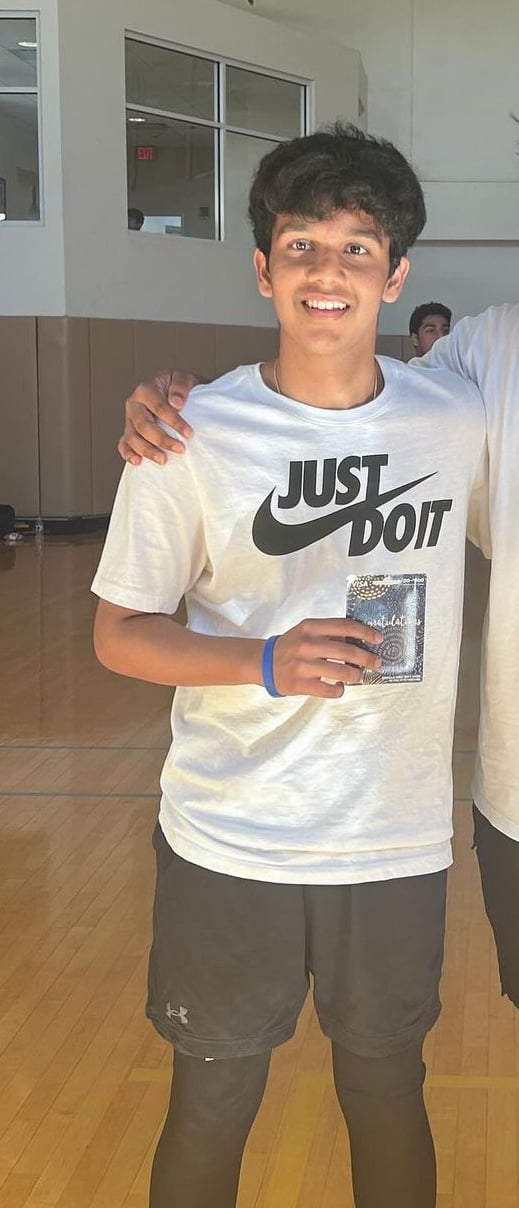

Student: Arjun Mehta

Piece: Exploring Decentralized Finance (DeFi) and Smart Contracts

During the Cryptocurrency 2.0 session, I dived deeper into the world of decentralized finance (DeFi) and learned about the practical applications of smart contracts. As a tech enthusiast, I was fascinated by how blockchain technology is transforming traditional financial systems. I decided to explore how smart contracts could revolutionize business transactions.

-

Understanding Smart Contracts:

I started by researching how smart contracts work—self-executing contracts where the terms are written directly into code. These contracts automatically execute when the conditions are met, removing the need for intermediaries like banks or lawyers. I focused on Ethereum, the leading platform for smart contracts, and experimented with creating a basic contract using Solidity, Ethereum's programming language. -

Real-World Application:

I created a hypothetical use case for a smart contract that could be applied in freelance work. In my example, a freelance designer and a client agree on a payment for a project. Instead of waiting for the client to manually send payment upon completion, the smart contract automatically releases the funds to the freelancer once the agreed-upon conditions (like delivery of the final project) are met. This eliminates the risk of non-payment and builds trust in the transaction. -

Investment Strategy in DeFi Tokens:

Alongside learning about smart contracts, I explored decentralized finance tokens like Aave and Uniswap, both of which operate on DeFi platforms. I created a mock portfolio that included these tokens to simulate investing in DeFi projects. I monitored how the tokens’ values fluctuated and how staking these tokens could generate passive income. -

Challenges and Risks:

One of the key takeaways from this session was understanding the risks involved in DeFi, such as security vulnerabilities and high volatility. I analyzed recent hacks in the DeFi space and learned how smart contract audits can mitigate these risks. This exercise helped me see the balance between innovation and security in the rapidly evolving crypto world.

Through this project, I gained hands-on experience with how blockchain technology can change the financial landscape. It inspired me to think about future career opportunities in fintech and blockchain development. This session was a game-changer in how I view the potential of decentralized systems, and I’m excited to continue learning and experimenting in this field.